what to do if you parents didnt save for retirement

12 Min Read | Sep 27, 2021

There's nothing quite like the sense of security and accomplishment when yous know y'all're on the path to a comfortable retirement. But that feeling tin quickly dissolve into stress—even guilt—when you discover your parents are lagging dangerously behind on their ain retirement journey.

"My husband and I are in a good place for retirement," Cerissa H. told usa. "Our parents, however, are not—and for different reasons." Cerissa'southward parents had careers in total-time ministry and never had a large income. On the other hand, her in-laws are drowning in debt thanks to several rental properties.

"We are concerned about their quality of life, the lack of long-term intendance insurance, and the debt," she said. "How practice we prepare for a life where nosotros will probably inherit adult dependents and debt? How practice we encourage my parents to maintain hope for their financial future? And how do we respectfully talk to my in-laws nigh their debt?"

A Lot of Usa Are Worried Nigh Our Parents' Retirement

It may not be much consolation, only many children of unprepared retirees are searching for answers to the same questions. The Employee Benefit Research Establish (EBRI) recently published a report on retirement and their enquiry found the following:

- Only fifty% of workers 55 and up have tried to calculate how much money they'll demand every month during retirement.ane

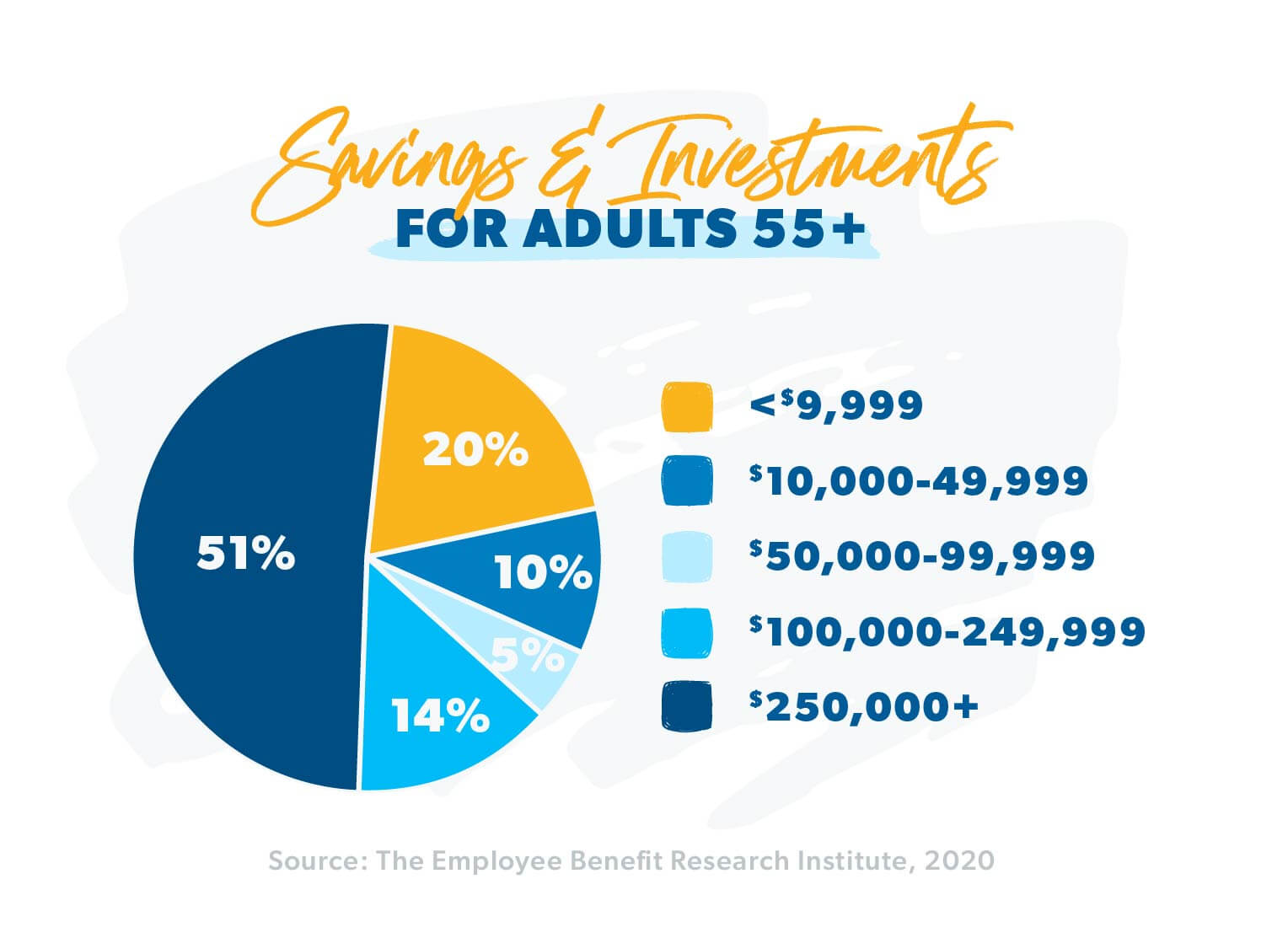

- Virtually 1 out of 5 seniors over 55 (xx%) take less than $ten,000 in retirement savings.2

- Approximately 31% of seniors aren't sure if they will accept enough to comprehend their medical expenses during retirement. 3

- Less than half (46%) of seniors take planned for how they would cover an emergency or large expense in retirement.iv

- Of retirees working for pay during retirement, 37% need the paycheck to make ends see.5

How much will yous need for retirement? Find out with this costless tool!

Many adults 65 and up likewise take limited avails to rely on when they retire, with 21% of elderly married couples and 45% of singles depending on Social Security for 90% or more than of their household income.half dozen

Gary Shaw, an investing professional, said all of this adds upward to a hard outlook both for retirees and their children.

"I recall what we've discovered is that parents really didn't program on non being able to live on Social Security," he said. "They didn't realize their expenses, especially their wellness care expenses, were going to be as high as they are. Or they didn't get their house paid off equally presently as they planned, so they still have to make a firm payment."

Jessica K.'south female parent is most 60 years onetime and has little retirement savings. Similar many other seniors, she sees no other option merely to keep working as long every bit she tin can. She'll draw on Social Security to fill up in the gaps of her income.

Katy C. can relate! Her mother-in-police force doesn't see herself ever retiring—often joking that her coworkers are going to have to "pry her cold, expressionless hands off her keyboard."

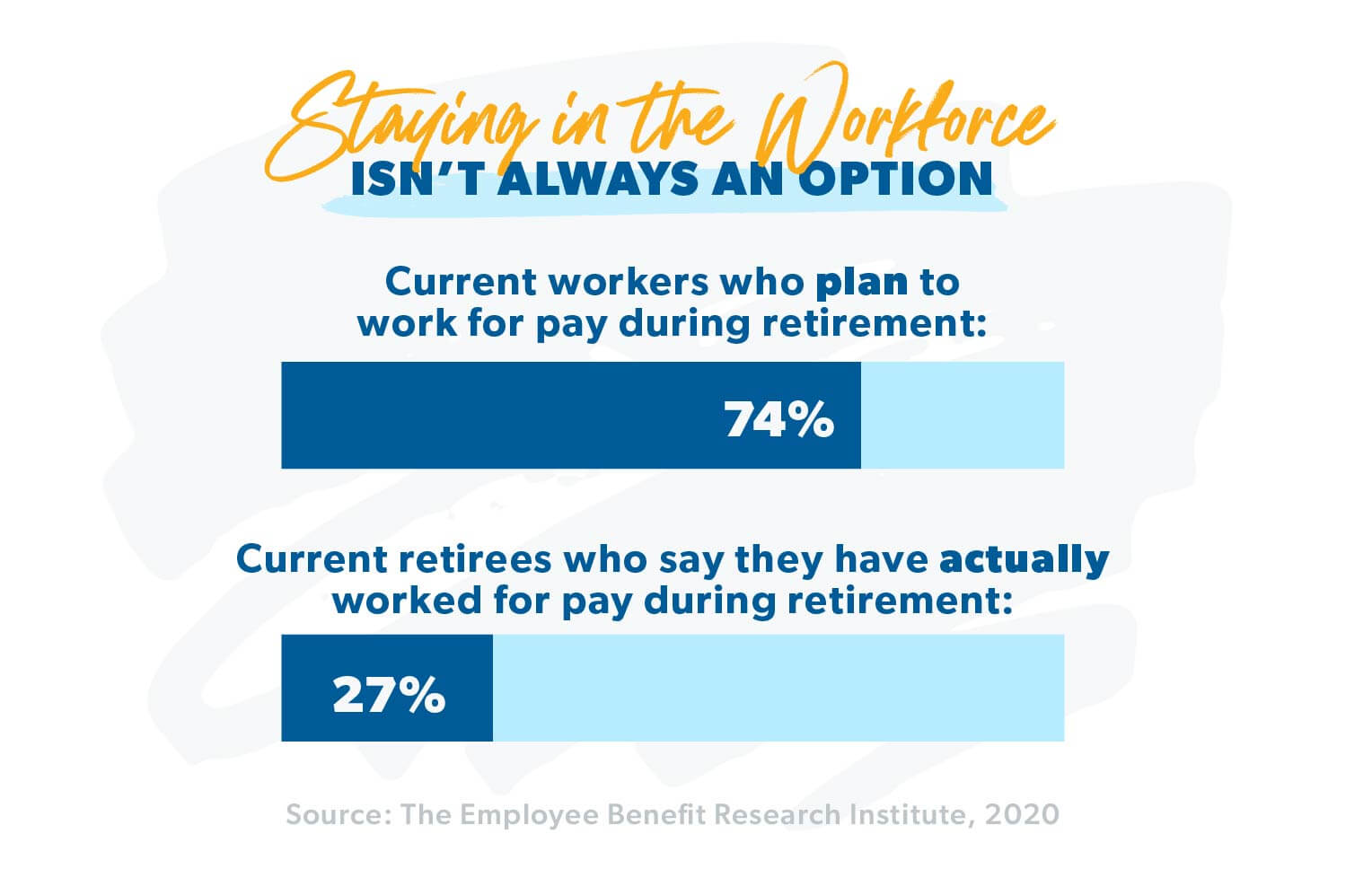

Co-ordinate to EBRI, Katy'due south mother-in-law isn't alone—virtually 74% of Americans programme to proceed working past retirement age.7

The retirement savings crisis isn't some problem nosotros're going to face up many years from now—it's already here. According to Pew Research, 10,000 baby boomers reach historic period 65, traditional retirement age, every day.eight But nearly half of them, 49%, take less than $10,000 saved for retirement.9 That'southward non okay!

How to Outset the Retirement Conversation With Your Parents

What you and your parents may have to confront in the future might seem overwhelming. But don't give up hope. It is possible to brand information technology through this tough fourth dimension with your parents' dignity and your own retirement plans intact.

The showtime step is to get a clear motion-picture show of what you're dealing with. Only how do y'all talk to your parents virtually their fiscal situation without information technology being tough on everyone involved?

"Sometimes the parents won't share all the details with the kids," Gary Shaw explained. "They don't want them to know how bad it really is. As a parent, you want your kids to look up to you. You don't want your kids thinking less of you because you didn't manage coin properly."

Jacob H.'s parents are struggling with that now. They're in their mid- and late-50s and believe they have no option merely to piece of work until they tin can't anymore. They're in debt and live paycheck to paycheck.

"I've tried to help them do a budget and the debt snowball," Jacob explained. "But they are very private nigh their money and don't desire me to see just how deep the hole is. I don't know how to make them encounter that I want to help them—not just for their future, merely for myself, my peace of mind, and my family unit."

Gary'south proposition to avoid putting parents on the defensive is to change the tone of the conversation. Rather than focusing on what your parents are doing wrong, begin by asking how they want you, the kids, to handle their coin when they no longer can.

To get the give-and-take started, Gary'southward team uses a tool called the "family love alphabetic character" as an icebreaker. The "family love letter"—a dear letter from the parents to the kids—is a document designed to make things easier when i or both of the parents are gone. It is a drove of all the of import financial and medical information put into ane place—the alphabetic character.

With the love letter every bit a guide, parents and children tin cover the nuts, then dig deeper into the problems as they work together to find the all-time possible solutions.

Retirement Talks With Your Parents Tin Still Exist Tough

Even with the lines of communication open, things don't always go smoothly. Once their true retirement situation is out in the open, your mom and dad could feel very vulnerable, making them want to resist change. You may need to assistance them empathize the need to alter.

Liz A. knows what that's like. Her mother is in deep financial problem. She makes proficient coin, only she's in debt and often has to borrow from Liz and her sister to pay bills. "She will not heed to anyone about her finances," Liz says. "She gets emotional and very, very defensive."

In cases similar that, Gary says it can be helpful to bring in a tertiary party equally backup.

"I had to have a tough talk with one retired couple," Gary told us. "The kids idea mom was spending also much, but they didn't know how to tell her—then they asked me to tell her."

The kids were correct. Their mom'southward spending had put her and her married man in danger of running out of savings in less than three years. Gary didn't sugarcoat the truth. He told Liz's mom that something needed to change. Either she kept spending like she was and the money would run out far sooner than she'd ever imagined, or she could boring down on the spending and her money might stretch an additional five or fifty-fifty six years. A little subject area could aid her go a long way!

"She got a niggling defensive at first, just after she let it sink in, she finally agreed she needed to stop spending and so much," he said. "That was a difficult conversation to have, simply it's a off-white thing to ask of your investment professional. We're here to walk through life with you—and this is a real role of life."

Your Retirement Is Still Your Priority

You may feel it's your duty to step in and help your parents make ends meet. You're non lone. Jessica 1000. voiced the same concern: "I'k incredibly scared of having to provide for my parents once they get to retirement age. I honestly don't know how nosotros are going to help them while trying to build up for our own future."

Gary's advice to Jessica and others in a similar boat? As tough as it may be, you accept to focus on your ain retirement plan offset. Then provide whatever help you tin can, when y'all can.

"Some kids are going to feel guiltier about that than others," Gary said. "But information technology's the same as when Dave says you should invest 15% for your retirement before you lot save anything for your kids' college.Your fiscal health is what volition makethem financially healthy—and then that's what you need to focus on."

Gary has seen this struggle time and time once more with his clients. "In ane instance, the girl of the retired couple felt obligated to aid her parents," he explained. "She and her married man had really adept incomes and were doing keen on the Infant Steps. In fact, they were on a good track to pay their own house off early."

Encouraging the couple to stick to their retirement plan, Gary brash the married woman to aid her parents by giving them small amounts of money to aid them make ends meet. Then, as extra coin became available, she could increment the amount.

"A few years down the route, they paid off their ain business firm, and that freed up a lot more cash each month," Gary said. "She was able to increment the money she was giving to her parents on a regular ground."

By taking care of her ain financial health, Gary's client was somewhen able to practise more to help her parents than she would have been able to if she and her hubby had sacrificed their goal of paying off their habitation early.

Paying off your home early, saving for retirement, being able to help loved ones—all of that can happen for you.

Protect Your Retirement With Long-Term Care Insurance

With their feet on solid financial ground, and with more than money bachelor to help the wife's parents, Gary recommended that the couple consider ownership long-term intendance (LTC) insurance for her parents to aid comprehend expenses related to nursing domicile, in-home or assisted living care.

"Information technology'southward going to fall on them later on to pick upward those expenses anyway," Gary reasoned.

Some other of Gary's clients, Sandy L., experienced the fiscal setback of her parents not having long-term intendance insurance. Her mother suffered a debilitating stroke two years ago, and she now lives in an assisted living facility then she can receive the level of care she needs.

Even though Sandy'due south parents built a solid retirement fund, it will only last another 12 to xviii months at the rate they're currently paying for her mom'southward intendance.

Gary'due south advice to Sandy and others like her is that a parents' LTC coverage is an investment in your future as much every bit information technology is your parents'. "Information technology's basically an estate-planning tool to prevent spending downwards your own retirement savings to take care of mom and dad in the nursing home," he explained. "We promise it'southward something y'all never demand, but information technology'southward better to pay $300 a month for LTC than spend $60,000 a year for the next 10–fifteen years for nursing dwelling care."

"I'm seeing immediate what happens when the money runs out—even when you've planned," Sandy said. "My husband and I are working with an investment professional to give us management now. I am thankful we started early to salvage regularly for retirement."

Times May Be Tough, only They Can Also Be Rewarding

Sometimes a parent's fiscal challenges end up existence a blessing for the entire family. As a single mom, Krystle Thou.'s mother was never able to build upward much of a nest egg. But when Krystle, her husband and their two kids moved from Pennsylvania to Southward Carolina, they invited her mom to come with them.

"We were fortunate enough to have her move in with usa," Krystle told us. "She watches our kids and helps out around the house. Substantially, she was able to retire when nosotros moved, and it has taken a bully burden off of her."

Though Lori W. and her hubby never had a large income, they were debt-costless. That gave them the flexibility to give her parents what they needed and go on their ain retirement savings on track.

When health issues made it impossible for Lori's mom and dad to live on their own, Lori took it upon herself to intendance for her aging parents financially and physically. "For the last three-and-a-half years, we cooked three meals a 24-hour interval and were on call 24 hours a day," she told us. "Nosotros did our best, and now that they take both passed away, we take peace knowing nosotros did what was correct for my parents."

Keep Your Retirement on Track by Working With a Pro

In the end, there'southward no magical solution that volition make supporting your parents in retirement a slice of cake. But with a lot of communication and teamwork, a delivery to stick to your own retirement plan, and a relationship with an investing professional, you and your parents can discover the silver linings in this challenging time—and maybe even discover a way to appreciate this new chapter in your relationship.

Are you looking for a qualified investing pro? With a client-first mentality, our network of SmartVestor Pros can help you lot retrieve long-term. They can educate and empower yous to achieve your retirement goals, and you can rest assured that your SmartVestor Pro cares as much about your financial hereafter as you do!

Notice a SmartVestor Pro today!

Almost the author

Ramsey Solutions

harndennottionged.blogspot.com

Source: https://www.ramseysolutions.com/retirement/how-to-help-your-parents-and-save-for-retirement

0 Response to "what to do if you parents didnt save for retirement"

Post a Comment